Capitalizing on Emerging Trends: Energy Transition, Robotics, and Sourcing for Unicorns

How PaperJet Ventures is Positioned to Invest in the Future of Technology

Welcome to the latest edition of Ante Up! In this issue, I’ll be highlighting several emerging investment trends that are shaping our strategy at PaperJet Ventures. As we continue to build a differentiated portfolio in Deep Tech and AI, we’re focusing on sectors experiencing transformation due to both technological advancements and a surge in capital allocation.

Energy Transition & Data Centers

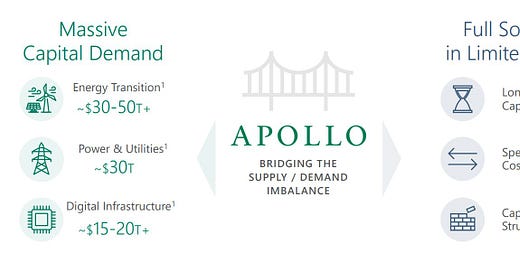

According to a recent presentation by Apollo, the capital demand to support energy transition projects is projected to reach $30-50+ trillion, particularly in renewable energy and digital infrastructure.

The rise of AI is further accelerating data center growth, positioning it as a critical sector for investment.

A single AI query is estimated to use 10x the energy of a typical Google search, and by 2030, conventional data centers could account for up to 15% of the nation’s total power consumption.

At PaperJet, we’re focused on investing in new material technologies that enable AI and data centers to scale sustainably and operate more energy efficiently. One example is a team I mentored at the MIT Climate & Energy Prize, which is developing innovative solutions to reduce energy consumption in data centers.

This trend is a key pillar in shaping PaperJet’s investment thesis.

Robotics: The Next Frontier?

Goldman Sachs recently reignited interest in humanoid robotics with Tesla’s announcement of its Optimus robot prototype. The global market for humanoid robotics could exceed $150 billion by 2035, driven by demand to address labor shortages in manufacturing and elderly care.

But for this vision to materialize, two critical challenges must be addressed:

Data: We have 15T text tokens, but robotics data is still limited. A diverse and large-scale data set is crucial. Progress has been made in teleoperation, AR data, simulation, and video learning, but real-world data remains invaluable yet scarce. Google, for example, spends $300/hour to collect it.

Hardware: Creating dexterous robotic hands requires advanced planning algorithms and the challenge of replicating human-like flexibility and strength. Low-level control and physical interaction are delicate processes. This should be where global collaboration adds value - some Chinese robotics companies are getting crazy good at hardware (but lag in AI), while manufacturing remains a challenge for U.S. players (but is far more advanced in AI). However, geopolitical concerns force U.S. companies to design and manufacture their hardware.

— Freda Duan, Altimeter Capital

PaperJet is actively exploring startups that can address these challenges and deliver solutions to unlock the full potential of the robotics market.

PS: I’ll also be attending the Tesla Robotics event on October 10—let me know if you’ll be there!

Sourcing Early-Stage Unicorns

A recent study by Defiance Capital, analyzing 845 unicorns, found that early-stage investment is highly fragmented. Here’s a key insight:

Outside of SV Angel (6.4%) and YC (10%), no other VC fund got into more than 2.8% (Sequoia) of unicorns.

— Source: TechCrunch

This fragmentation presents an opportunity for emerging funds like PaperJet to identify and back outlier startups before they gain broader attention.

Additionally, over half of unicorn CEOs have degrees from the top 10 global universities, with a strong concentration in STEM fields. This supports our strategy of partnering with university labs from top-tier schools and focusing on founders with deep technical backgrounds.

Our Investment Strategy: Execution & Transparency

Through years of investing, we’ve observed a positive correlation between founders who prioritize execution and provide consistent updates and their long-term success. These founders tend to navigate challenges more effectively, which is why we consider these attributes critical in our investment decision-making process.

Opportunities on the Horizon

We remain engaged in discussions with various startups in these sectors and are leveraging our relationships with university labs and corporate VCs to build a robust deal pipeline. If you have any connections or insights in these areas, I’d love to explore potential collaborations.

Thanks for reading! Feel free to reach out with any questions or feedback.

Best,

Chris

P.S. Intrigued? There’s a shiny sign-up button below to stay updated on the latest trends and insights!