Introducing PaperJet Ventures

Transitioning from solo angel investing to syndicate lead

Editor’s note on March 31, 2023 - The syndicate name was changed from Renegade Capital.

After investing in tech startups and building a network of founders, experts, and investors for the past two years, I'm taking the next natural step and starting my syndicate, PaperJet Ventures.

What is a syndicate?

A syndicate is a group of investors that pools their capital to invest in deals (SPVs). As the syndicate lead, I first source a deal and then invite other accredited investors to support the investment in exchange for them to pay a carry, which is a percentage of the investment's profits.

Why Now?

Since I started my angel investing journey in early 2021, I have invested in over 50 startups. You can see a summary list on my Notion page.

I've learned much on my rollercoaster journey, from the bull market's peak to the downturn driven by an uncertain macroeconomic environment, with rising interest rates and recessionary fears. I have documented my learnings on this blog.

These learnings help me refine my decision-making process. As the market exuberance has ended, we are reaching an exciting point as investors.

There is no better time to invest in startups.

Valuations have come down considerably to historical "normalized" levels.

The challenging fundraising environment has created a new cohort of founders who are more gritty and resourceful in dealing with near-term uncertainty.

I am excited to see more founders have a longer-term mindset with a greater focus on managing their startups' burn rate and building sustainable businesses in these uncertain times.

PaperJet Ventures aligns with my plan to scale my angel investing in hard tech, AI/ML, and SaaS. I can continue to build my network, knowledge, and capital through PaperJet Ventures to capture more investing opportunities, especially with my angel investor friends (many from Hustle Fund's Angel Squad).

What is PaperJet Ventures About?

PaperJet Ventures invests in founders with bold and disruptive ideas at the earliest stages. For founders, PaperJet Ventures provides real tactical support for promising founders with my deep finance background and Silicon Valley experience.

With my finance skillset, I have the knowledge and tactical skills to advise founders to navigate complex fundraising and investor management processes. I'll work on behalf of your interest, from tactics and deal mechanics to sharing "insider" knowledge.

As a former founder, I learned firsthand how challenging it was to build companies from zero to one. As a former product manager, I have the experience and insights to help early-stage startups to find their product market fit.

With these experiences and strong empathy, I am the right ally for the founder on the cap table.

At PaperJet Ventures, I seek deals where I can add value, such as helping founders with fundraising, business development, product/design advisory, and connecting them to the right people! (More on this in the Startup Helper section below.)

Core Areas of Focus

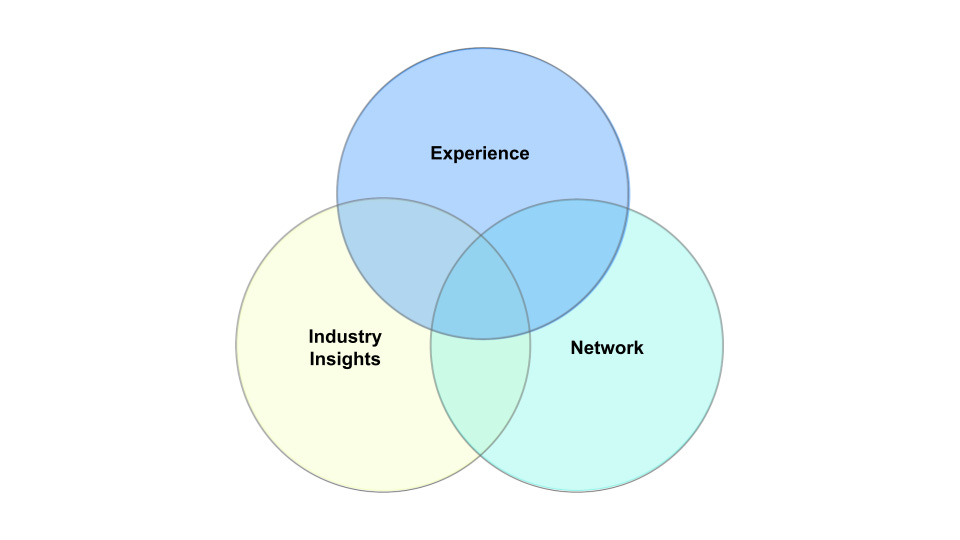

On a high level, PaperJet Ventures’ investment style is identical to how I currently invest based on my own operating experience, industry insights, and network.

Before working in tech, I spent many years in investment banking, where I gained insights from covering various industries. I closed US$15+ billion of deal transactions in the media, telecommunications, natural resources, transportation, and utility industries during that time.

These insights gave me the foundational knowledge to perform deep research and due diligence, which has helped in my public and private investing process.

In addition to the network I built via my professional experiences, I was fortunate to find other like-minded investors who shared my passion for startups, especially the ones I connected with from Hustle Fund’s Angel Squad.

Based on these three criteria, PaperJet Ventures' core focus areas include Hard Tech, which is defined as startups that are "working on hard technology problems that have more world-changing potential." Good examples include self-driving cars or building rockets.

I am particularly excited about founders tackling complex problems to transition the world to the "electrification of transportation" future.

I'm also excited about builders who can solve our supply chain constraints with advanced manufacturing solutions. Many startups operating at the intersection of software and hardware are building software-enabled workflow solutions and automation.

While AI is experiencing a massive renaissance with the emergence of Chat GPT and Generative AI, I'm particularly excited about the possibilities of "Copilot for Professions" (a term coined by Reid Hoffman recently).

Shaped by my experience in the corporate world and my previous startup of building AI solutions in the legal tech space, I'm looking for startups that can transform jobs in the financial and legal industries.

Another main focus is vertical enterprise/SaaS solutions within industries where I have solid insights and knowledge. I'm looking primarily for solutions with strong business use cases that provide clear value for customers with solid unit economics.

Sitenna, PaperJet Ventures' first syndication deal, is an excellent example of this core focus.

Here is PaperJet Ventures’ Investment Thesis 1.0.

Why Me?

Angel Investor & Startup Helper

I invest primarily in pre-seed and seed-stage companies. I focus on sectors where I can add value by connecting to the right people & having deep domain experience. To better understand my investing strategy, check out the blog here.

The best part about being on the cap table as an investor is the opportunity to form deep relationships with founders and be helpful in problem-solving in the early days.

Here are some testimonials from founders that I backed:

The investor you want on your cap table! YC has a saying - "don't ignore the small cheques." This couldn't be more true for Chris.

He is incredibly supportive commercially, operationally, and on follow on investment. His network becomes your network, and he's there if you need any advice or support. I'm delighted to have Chris as an investor in Sitenna - Daniel Campion, Co-founder & CEO of Sitenna (YC S21)

Chris was the fourth person to invest in H3X and has consistently been one of the most helpful angels on our cap table. He is always willing to help and knows how to identify strong teams and pick winners. It's been a pleasure to work with him the last couple of years. - Jason Sylvestre, Co-founder & CEO of H3X (YC W21)

Here are some notable examples of things I have done for founders:

Fundraising

Helped founders raise over $400K (as of 1/24/23) from introductions to VCs, syndicate leads, and angel investors and running successful deal syndications.

Provided a hard tech startup founder with valuable market insights and deal terms comparables to help him prepare for the upcoming Series A fundraising.

Product & Design

Collaborated with designer/angel investor Jaireh Teccaro to help founders of a fintech startup to improve its iOS app onboarding user journey.

Biz Dev & Sales

Introduced founders to potential customers (including a tier 1 company with over $100 billion market capitalization) and strategic partners.

Introduced an angel/operator for a startup advisor role in partnerships and contract negotiation.

Non-dilutive Funding

I introduced three climate tech founders to a consulting firm that specialized in helping startups to apply for federal grant programs.

As referenced earlier, I have had a strong network with my angel investor/operator friends since I joined Hustle Fund's Angel Squad.

Over time, I build deep relationships and identify my angel investor friends' unique "superpowers," ranging from design advisory and fundraising to brand marketing/SEO.

For any founder reading this, PaperJet Ventures' most unique differentiator is the people behind it. There is a team of "Avengers" who can bring tremendous experience and expertise to guide you in your early-day journey.

We are with you all the way: from your introductory meeting through due diligence and post-investment – you will have access to our network of operators/investors to answer your "founders ask" questions.

To summarize, my biggest differentiators as an investor are

My deep finance/banking background provides founders with tactics and insider knowledge to help them navigate the fundraising process.

My industry knowledge allows me to do deep market research and due diligence within my core focus areas.

Previous operator experience, where I can empathize and problem-solve with founders.

Network, where I can connect founders to the right people.

Future Resources for Founders

For 2023, I have ideas to share best practices and valuable resources for founders:

Finance series on fundraising, cap table, financial modeling/budget, and more.

Job hiring board for portfolio companies.

Overview of non-dilutive financing programs and other non-equity funding, including equipment financing and debt.

Office hour for founders to review designs with Jaireh Teccaro and other product managers/designers.

A series dedicated to future/next-generation founders coming from major engineering programs.

Final Note

For founders working on interesting problems, especially within those core focus areas, please email me at christopher.j.kong@gmail.com.

If you are an accredited investor interested in angel investing, consider joining PaperJet Ventures. There is no pressure to invest as I want to provide more access for everyone to get your "deal review reps" before writing any checks.

If you want to learn more or have more questions about this, please contact me on Twitter.

Thanks to Jen Liao and Jaireh Tecarro for providing valuable insights and reading drafts of this post.

PS: Sign up☟ if you find this interesting. Email me if you have any excellent topics for me to explore more!

If you liked this post from Ante Up Newsletter, why not share it?