Understanding Your Startup's Equity Offer

Learn to evaluate like an investor for better decisions & financial outcomes

While it's common for tech startup employees to get equity compensation, few truly understand how it works.

When I talked to many former colleagues and other Hustle Fund Angel Squad members, many expressed how regretful they felt about not understanding how to value their employee stock options/grants BEFORE they joined the company.

According to a recent Wall Street Journal article, startup employees who quit during the pandemic to join new companies suffer from the "job-market equivalent of buyer's remorse." Top reasons behind employees' regret range from role being a poor fit to high expectations driven by employers' overpromising not being met.

Given the dramatic shift in the current market environment that favors startup job seekers, it is vital to understand how startups' stock options/grants work. Compared to the last two years, we have seen less stellar capital markets in 2022 that affected many late-stage startups, including the high-profile Fast shutdown and Instacart's surprise valuation cut.

In my last post, I argue how angel investing can provide the ultimate cheat code for finding the best startup jobs. If you get an offer from one of those hot startups, you should think like an investor to help you evaluate their equity offers, including the potential upsides as shown below.

The Initial Offer

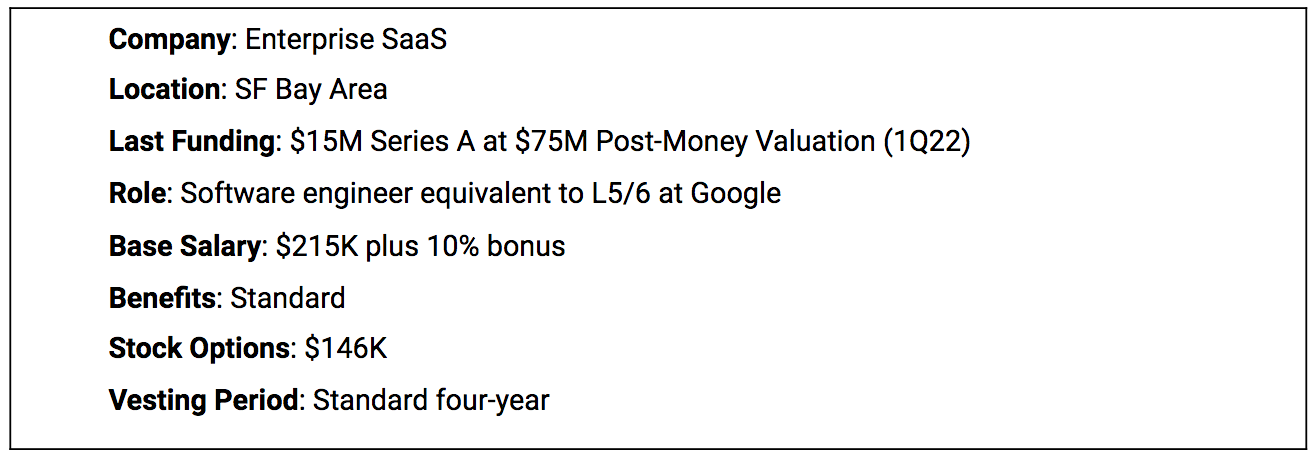

Let's use an actual offer to figure out how to evaluate startups' equity offers. Recently, my engineering friend received a job offer from a Series A startup based in the Bay Area, and he has agreed to let me use it as an example. For privacy, I will slightly modify some of the details.

Note that I will only focus on the equity component of the offer. You can use resources such as Levels.fyi to compare base salary and other benefits. I need to include the disclaimer that this is not legal or tax advice. Please research and consult with your professionals before making any decisions.

Step 1: Understand what ownership I am getting.

Tech startups’ job offer commonly includes a stock grant structured as stock options or restricted stock units (RSU). You can read about the difference here.

The biggest mistake is not asking the hiring manager how much ownership the stock grants represent. In many cases, it's easier for the hiring manager to communicate the compensation offer to the potential employee to include the dollar value of the equity grant ($146K of stock options in this example).

The potential employees should know what percentage of ownership of the startup they will own once all those options are fully vested (and exercised) after the vesting period.

Let's assume my friend was able to ask further about the details of the stock options, which should include either the percentage of ownership or total outstanding shares issued by the company and the strike price. Here is the summary of his employee stock options offer:

If you want to understand more about startup stock options, I recommend reading this.

Step 2: Benchmarking

Before we benchmark the stock options deal, I want to point out that it's a mistake to assume that startup founders know how to hire and compensate employees adequately.

Founders need to get advice on how to issue equity to employees. Yin Wu from Pulley wrote a very extensive post on Stripe Atlas to help founders understand how to issue equity to employees, which you should check out. Gusto also published a comprehensive guide for founders to structure and issue employee equity.

Once you understand the mechanics of how founders recruit, reward, and retain employees, it will help you negotiate to optimize your earnings potential from these startups fully.

Once you have the stock option grant's ownership % (0.2% in this example), you can determine how fair the compensation package is by benchmarking the data. AngelList has a tool where startup employees can benchmark salary and equity with filters that include role, location, skills, and market.

Here is the result of my friend's benchmark for startup equity comparison using this interactive tool:

As you can see, the ownership % (0.2%) of my friend's startup equity offer is on the lower end of the range. Depending on the startup's needs & skills requirements, he should consider going back and negotiating for a higher number of stock option grants. Other useful negotiation options include a lower strike price or a shorter vesting schedule. Again, this is not financial advice - just some general pointers on how to think about a startup's equity offer.

Step 3: Understand the Potential Upside

Jason Lemkin tweeted a simple guide on how to think about the potential upsides for startups in various stages. He also wrote a post that includes additional insights:

Seed and "Early" Series A investors are looking for you to have a shot at doing 100x their money.

Series B and Series C, and later-stage Series A … anything much higher than a $60m valuation or so … is looking to 10x their investment in you.

Pre-IPO investors are looking for 3x. Pre-IPO investing, i.e. unicorn stage, are looking in general for at least 2x-2.5x returns. 3x ideally, like seed and middle stage.

Thinking like an investor, employees should think about the potential upsides when considering startups at different stages. For example, my engineering friend is contemplating joining this early-stage startup that just raised a round at a $75 million post-money valuation. In that case, he should ask if he sees a potential 100x exit at $7.5+ billion.

If he was considering a pre-IPO unicorn valued at $1 billion, is there a possibility of a $3 billion exit on the horizon? My favorite exercise is finding comparable companies in both private and public markets.

Let's assume my friend is thinking about joining that Series A company. We can model out and summarize the potential upsides as that startup progresses to different rounds.

The most significant assumption in this exercise is startup dilution for each funding round. Dilution is a complex subject that I will cover in-depth in a future post about angel investing & modeling. Here is the formula for the relevant calculations:

Here are potential upsides as that startup progresses to different rounds:

Suppose my friend was able to vest and exercise all his options, and the startup was able to hit various milestones to hit Series D after five years or so. In that case, you can see the potential value of those options could hit $1 million post-dilution. There is no liquidity exit to realize that $1 million value unless the startup has a successful exit, such as IPO or acquisition by a larger company.

By that stage, the employees sometimes have the option to sell their shares on secondary markets such as Forge (formerly SharesPost) or EquityZen. Again, it's not financial advice, but this is a unique way to think about your equity potential upsides.

Another upside consideration is Qualified Small Business Stock ("QSBS"). The rule includes several criteria, including the company having less than $50 million of gross assets at issuance and you must hold the stock for at least five years. If you hit the jackpot, you may be qualified for capital gains exemption up to the greater of $10 million or 10x the initial investment. Again, this is not tax or financial advice, but you can learn more about QSBS here.

Step 4: Understand the Downside

Founders and employees usually get common shares instead of preferred stock, which investors such as VCs typically get. You can read about the difference here.

Since most startups are not cash flow positive, they don't necessarily qualify for debt. So, let's focus only on preferred equity and common equity in the downside scenario.

A key term that you should learn about is liquidation preference.

"A liquidation preference is designed so that preferred shareholders (the investors) receive their money back before any of the common shareholders (employees and founders)." - The Ultimate Guide to Liquidation Preferences.

Liquidation preference will not be relevant if a startup has a massive exit, such as an IPO since all preferred shares automatically convert to common shares.

Suppose the startup ever got into bankruptcy or is sold for less than its last 409A valuation. This is where liquidation preference plays a significant role, given its designation to help investors mitigate startups' investment risk.

Let's assume my friend joined the startup after the Series A round, but unfortunately, the company ran into trouble and had to exit by being acquired by another company. Liquidation preference would then come into play, where the investors' preferred stock would get paid first, and whatever is left will remain for the common stock owned by founders and employees.

In the event of acqui-hire like Fast winding down sale to Affirm, employees' common stock is practically worth very little to zero. In this situation, the acquirer company would want to retain the startup's talent by offering a good retention package to compensate for the loss of those common stocks.

Next Step

My next post will be a comprehensive guide on how to figure out the probabilities of the startups' upsides & downsides by evaluating the company as an investor. Please subscribe below to get notified.

If you are interested in learning more about investing or have more questions about this, please reach out to me on Twitter.

Thanks to Jen Liao and Jaireh Tecarro for reading drafts of this and providing valuable insights.

PS: Sign up☟ if you find this interesting. Email me if you have any excellent topics for me to explore more!