Y Combinator's New $500K Deal

Demo Day Impact For Both Founders & Investors

Y Combinator (“YC”) has recently made waves by offering a generous $500K upfront investment for any startup that enrolls in its 3-month program. The deal was criticized heavily by many early-stage VCs as they felt YC had upstreamed them in the fundraising process that could impact their deal flows, much like this clip.

From YC’s perspective, they have no choice but to up the ante to keep up with the current market that is so hyper-competitive with the influx of money flows into early-stage VCs, operator/angels running micro funds, etc. In the last 2 Demo Days that I have participated in, many hot deals were well-oversubscribed, and valuations get marked up heavily by Demo Day thanks to many “front-running” tactics from investors who pro-actively approached startups super early in the program.

To own the top of the fundraising funnel in the seed round, it’s not a surprise to see YC revise its standard deal plan to adjust to the current market condition especially given its significant role in preparing these startups during the 3-month program.

For YC founders, it’s a win-win deal since it allows new startups in the program to either 1) destress fundraising or 2) focus on growth to create FOMO on Demo Day.

To understand the impacts on both founders & investors, let’s first double click on the actual deal itself:

YC’s New Deal

In the past, founders that get into this most-sought accelerator program (well known for its low 1.5-2% acceptance rate) receive $125K of funding in return for 7% of ownership. If you are curious why startups would give up so much equity to get into YC, this is a good article for you.

With the new deal, YC provides an upfront $500K of funding at the start of its program that is “not contingent on any milestones.” The deal consists of 2 terms:

Existing $125K in exchange for 7% of ownership; and

Additional $375K on an uncapped SAFE with a Most Favored Nation (“MFN”) provision - upfront money on terms that founders will negotiate with future investors.

It’s the addition of this $375K upfront funding that could double YC’s total ownership that has many early-stage VCs balked at.

To provide a more precise context, let’s run the math based on the last YC Summer 2021 batch’s average valuations provided by Immad Akhund, the founder of Bank Mercury, YC Alumni & active angel investor, as shown below:

Supposedly, you are a first-time founder and were able to successfully secure $1.2M on a $15M post-money valuation (8% dilution). Here is a summary of the cap table after the seed round:

Based on the definition of MFN provision, YC doubles its ownership to 15% since it got the best term negotiated in the seed round, as shown above. Total dilution is 23%, which is higher than the average seed round deal.

To understand the implications for founders in the program, I spoke to a couple of YC alumni about the deal.

First-Time Founder - Destress on Fundraising

For the first-time YC founders, this new deal structure allows them to destress on fundraising and figure things out, such as building the initial products.

Firstly, it’s not uncommon to see some YC founders get into the program based on ideas alone. The rigorous 3-month program allows these founders to have the opportunity to quit their full-time jobs and be laser-focus on building their startups while getting access to top advisors and being able to tap into YC’s vast network. Many B2B startups’ early initial customers come from other YC startups.

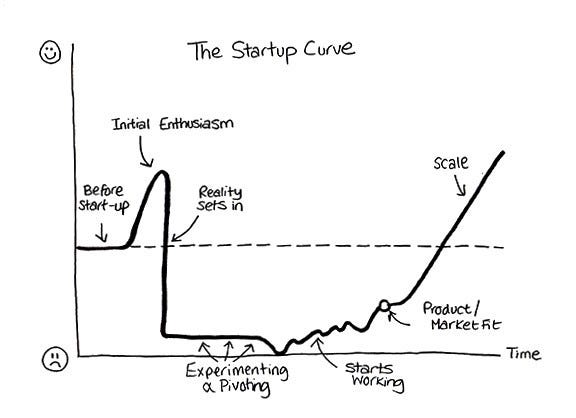

In some cases, startups in the YC program might have to pivot. The additional runway allows these startups not to panic over running out of money but instead let them find their feet instead of talking to investors.

Experienced Founder - Position for Demo Day’s FOMO

Experienced founders can spend the additional YC funding to either hire team to build great products or spend on growth marketing for products that already exist in the market. By delaying fundraising, these founders can figure ways to create “hockey stick growth” to position their companies as the “breakout” ones in the large YC batch and be able to command significantly higher valuation post-Demo Day fundraising.

To illustrate this point, let’s use the example above. Supposed a software company was able to leverage the additional runaway towards growth marketing and successfully grow their revenue to $30K+/month and put itself in a position to raise at $25M post-money cap. Assuming the seed round amount remains the same, the total dilution under this scenario would be 17%, lower than the scenario above.

What About the Additional Dilution?

Based on the conversation with the YC founders, they think the additional dilution from the uncapped note is relatively small compared to the average valuations command by YC startups. Since the average seed round pre-money valuation is now $15M according to the 2021 AngelList report, YC startups for the upcoming Summer 2022 batch should be able to command a much higher valuation in comparison.

According to one of the YC founders who also invest in other YC startups, certain funds and established angel investors might find it harder to “front-run” Demo Day. To understand this, here are the critical timelines of how it usually works with YC fundraising.

YC startups’ participation in the upcoming batch gets announced on social media. Seed-stage VCs and angel investors will start approaching founders even though Demo Day is months away.

There is also a YC Alumni Day, typically the weekend before the actual Demo Day. More YC alumni are investing in other startups in the current bull market than ever before.

Demo Day, where the general investor communities get to hear each startup founder pitches as part of the fundraising process.

If founders are going to delay fundraising until Demo Day, certain seed-stage VCs and angel investors might not get a chance to meet many companies until later than what they are accustomed to. Given the current high number of active investors, I expect to see much higher opening valuations by Demo Day.

For hardware or deep tech companies, the impact is less significant since they require a higher amount of capital, and almost all the ones I have seen are still in the early prototype / pre-revenue phase.

Impact on International Investors

YC has significantly expanded its program in the last few batches since Demo Day has gone fully remote during the pandemic period. The most significant change is seeing more startups than ever come from emerging markets such as Latin America and South-East Asia.

YC’s $500K deal is even more significant for first-time founders in these regions since they usually raise money from a smaller pool of early-stage investors. These funds represent much longer runways when translated to local currencies.

By having the best deal in town by far, YC has “upstreamed” international investors, which has caused some negative responses, as shown in the thread below:

Bridge to Series A Program?

With the recent successes of YC startups with significant exits, including Airbnb, Doordash, and Coinbase, the accelerator program has access to funds to invest more than ever.

In addition to running its accelerator program, YC does provide some resources to help startups prepare for the Series A fundraising process.

Given the new deal and greater ownership of its startups’ cap tables, I expect YC to play a more active role in their startups post accelerator days and bridge towards its own Series A program.

Impact of my own YC Deal Sourcing

I started investing directly in YC startups from Winter 2021 batch onwards. In the beginning, it was challenging, given my limited experience, network, and capital. My initial strategy was to study all the YC launching on Hackers News before Demo Day. I would then prioritize startups that I am interested in within the sectors that I have strong knowledge and network. Once I have sufficiently done as much due diligence as possible, I will try to approach founders on LinkedIn or Twitter to set up intro meetings.

From my investor experience, it is very competitive if you start approaching founders after Demo Day, given the number of attendees watching all the presentations. This approach can work if I can find the right startups that have just started their fundraising process. As I can build a track record and, more importantly, network, I can get more referrals and inbound deal opportunities.

Given my interest in investing in deep tech, I still expect to approach startups with cold inbound, given these companies require more capital than typical software companies. Nevertheless, warm introductions and referrals from other founders and investors are more likely to increase my chance of connecting with exciting YC startups.

While this upcoming Winter 2022 batch will be more competitive for investors, the YC founder I spoke to reassured me that the average angel investors are typically 10x more helpful than VCs. He would still be looking for helpful ones. So, I plan to keep building my reputation as a helpful investor to earn myself the seat on the cap table, and that’s the way it should be!

Overall, this is a win-win deal from the YC founders’ perspective. Helpful investors will always find ways to adjust to their investment opportunities. Having additional runaways will give founders more time to focus on their businesses instead of fundraising.

I look forward to the next YC Demo Day to see if some of these predictions will come through. To register for the Demo Day, click here.

If you are interested in learning more about investing directly or have more questions about this, please reach out to me on Twitter.

PS: Sign up☟ if you find this interesting. Email me if you have any excellent topics for me to explore more! Also, a special shoutout to Jaireh Tecarro for reading the draft of this.